Trump Gains Control of the U.S. Economy as Taxes and Tariffs Are Implemented

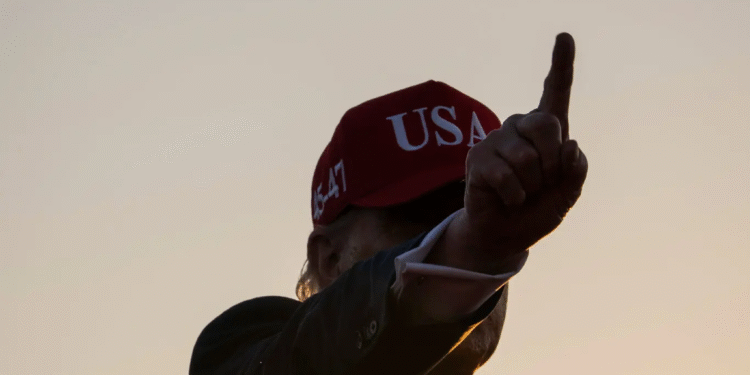

The majority of President Trump’s program has been realized, giving him complete control over the future of the economy.

He has signed into law his costly tax reductions. His high tariffs are becoming more apparent. He is also making progress on his twin initiatives to deregulate the government and expel immigrants.

Having already made an indelible imprint on the American economy, President Trump’s main legislative goals are now coming into clearer focus. He will be entirely responsible for the upcoming highs and lows.

Just six months into his second term, Mr. Trump has pushed forward with the ambitious and possibly ground-breaking economic experiment that he first hinted at during the 2024 election. Based on the assumption that some of the worst warnings from economists are incorrect, his actions in recent weeks have put the future of the country’s finances and its centuries-old trading partnerships at risk.

Despite warnings from fiscal professionals that the legislation could harm the poor and put the US government on a dangerous new fiscal course, the president passed a comprehensive package of tax reductions last week that he believes will fuel rapid economic development.

As economists warned about a possible increase in consumer prices that might result from taxing imports, Mr. Trump then started his most recent round of tariff threats on Monday, declaring that “we’re done” with negotiations.

The White House also moved ahead with its contentious and aggressive strategy to deport millions of immigrants and get rid of hundreds of federal regulations. According to experts, the immigration crackdown may have negative consequences for several industries, notably agriculture, that are heavily dependent on foreign workers.

Thus far, the U.S. economy has withstood these significant shifts, and Mr. Trump has blamed the slightest bit of bad news on his predecessor, former President Joseph R. Biden Jr.

I believe that the Trump economy is the good part and the Biden economy is the bad part because he’s done a terrible job, Mr. Trump said to NBC’s Meet the Press in May.

However, the president is now in charge of the highs and lows on the horizon because he has accomplished the majority of what he intended. The next few months will be a test of whether he is right in claiming that his program is not as dangerous as many economists have predicted, or if he is simply enjoying a lull before a destructive storm.

We asked the White House for comment, but they didn’t answer.

Although there are few indications of stress, the U.S. economy still seems robust for the time being.

The US economy created 147,000 jobs in the previous month, surprising experts. Nevertheless, the sources of that expansion also seem to be contracting, as seen by the ongoing decline in manufacturing employment and sluggish employment in the retail and professional services industries. The unemployment rate fallen to 4.1 percent however the number of those who had been out of work for more than six months increased.

Americans have begun to reduce their purchases after months of stockpiling in anticipation of Mr. Trump’s tariffs, resulting in a slowdown in consumer expenditure, the main engine of U.S. economic growth, even if inflation remained comparatively subdued during May.

Despite everything, David Kelly, the top worldwide strategist for J.P. Morgan Asset Management, continued to characterize the U.S. economy as a “relatively healthy tortoise” that is slowly but steadily growing and resistant. By the end of 2025, he predicted that the nation’s gross domestic product, which is a reflection of its overall production, would increase by around 1% from the previous year.

However, as some of Mr. Trump’s new policies begin to take effect, he said the economy has reached a “bit of a diversion in the road.”

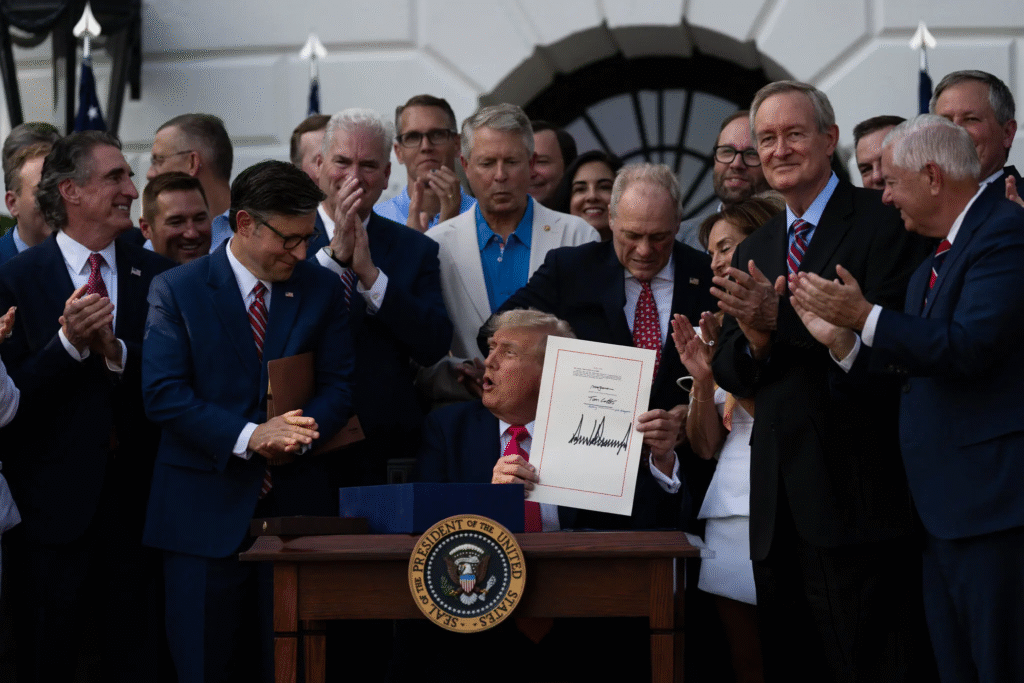

The core of that program is a costly new domestic policy bill that Mr. Trump enacted into law on Friday. For the most part, the package maintains a number of low tax rates that were achieved throughout the president’s first term, while also providing new and, in some cases, significant tax breaks for companies, seniors, and specific employees, such as those who earn overtime.

Congressional analysts previously discovered that many Americans, especially those who are wealthy, may experience a drop in their tax burden in the next several years. However, the bill is still anticipated to increase the debt by over $3 trillion, and Republicans paid for that package by making severe cuts to federal safety net programs, which may leave lower-income Americans worse off.

The bill’s expense will cause a key indicator of the nation’s fiscal imbalance—the ratio of its debt to its total output—to reach a level that hasn’t been seen since after World War II, according to Maya MacGuineas, the president of the Committee for a Responsible Federal Budget. Not just for the government but also for everyday Americans, this would raise the cost of borrowing and put a strain on private investment.

Ms. MacGuineas, whose organization supports deficit reduction, said, “This will slow economic growth.”

Those forecasts have been dismissed by Mr. Trump and his senior staff. The tax law, as well as the remainder of the president’s program, would bring in enough money and economic activity to lower the deficit by about $11 trillion, they predicted last month. Some of the administration’s projections have been characterized as overly positive, even by conservative economists.

“The growth that’s solely attributed to the tax cut is way too hot, even compared with what conservatives like me would say,” said Glenn Hubbard, who chaired the Council of economic advisers during Bush administration. “It’s just way, way, way out of line.”

It is anticipated that some of that income will be generated by Mr. Trump’s tariffs, which he increased this week. The president warned Monday that unless the original group of 14 nations agreed to fair trade agreements with the United States, levies might reach 40%.

As Mr. Trump promised that “the big money will start coming in on Aug. 1,” he pledged to announce new tariffs on imported medicines, computer chips, and copper by Tuesday. The president’s top advisors have stated that they anticipate collecting over $300 billion in tariffs by the end of the year, and Mr. Trump is expected to notify at least seven additional nations next month about the increased tariffs they will be subject to.

Mr. Trump’s trade brinkmanship began in April, when he imposed and then repealed a massive list of exorbitant tariffs in an attempt to reach trade agreements across the world. During that 90-day break, the majority of economists warned that if his tariffs were implemented, they would cause significant economic harm. This week, as the president intensified his strategy, they reiterated their warnings.

Douglas Holtz-Eakin, the president of the conservative American Action Forum, stated, “Whatever is in place at the end of the day is going to get passed along; it’s just a matter of when.”

The president’s responsibilities, including those in the next month, will result in an average household income loss of $2,300 this year, according to the nonpartisan Yale Budget Lab.

However, the White House has consistently refuted similar projections and generated its own estimations. On Tuesday, it discovered that the cost of imported items has decreased more since February than the cost of all commodities. While economists later challenged some of the report’s findings, Mr. Trump’s senior advisers claimed that it demonstrated that the president’s tariffs were not causing “an acceleration of inflation.”

“There’s no sustained pattern of a tariff-driven price pressure anywhere,” Stephen Miran, the head of the White House Council of Economic Advisers, told CNBC.

The Federal Reserve has been paralyzed by the enormous uncertainty, particularly around tariffs, and has maintained borrowing costs unchanged for months as it waits to see the full impact of Mr. Trump’s policies. Jerome H Powell, the head of the Fed, whom Mr. Trump has dubbed “Mr. Too Late” for not lowering borrowing rates as he has asked, has given the president a handy “fall guy.”

“Blaming bad economic data on an ‘incompetent’ Fed chair can almost suit you as president ending up with things like tariffs, inflation and pushing down growth” said Mark Dowding, the chief investment officer.