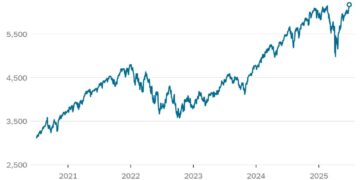

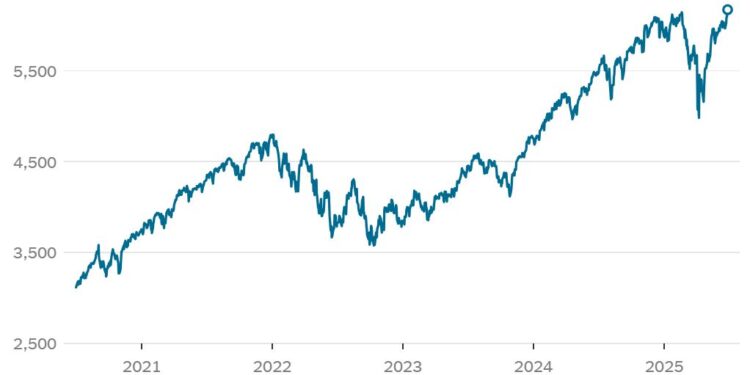

Trump Turmoil Fails to Prevent the S&P 500 from Reaching an All-Time High

When President Trump announced his extensive list of tariffs in March and early April, the index had lost all the gains it had made.

The S&P 500 reached a new peak on Friday, marking the end of a quick rebound to a level that was last seen in February, when hopes of a new business-friendly administration gave way to widespread worries about the effects of trade tariffs.

The stock market, which was just a few months ago in the grip of investors’ concerns that President Trump’s tariff measures would wreck international trade, has made a remarkable turnaround.

When President Trump unveiled his wide range of tariffs in March and early April, sparking fears that the United States was bringing its position as the world’s most vibrant and dependable economy to a self-inflicted conclusion, the S&P 500 has since recovered all of its losses.

When Trump postponed the imposition of the harshest tariffs of his administration until July, the march started on April 9. Despite ongoing difficulties such as inflation and a war in the Middle East, the S&P 500 has increased by over 23% since then.

Investors concluded that the government would not allow the stock market to decline too much after Mr. Trump chose to postpone the introduction of new tariffs. The day before he declared he would halt the tariffs while he looked for agreements with trading partners, the S&P 500 was on the verge of entering a bear market, which is a sign of widespread investor pessimism.

The president’s reversal, along with the following rally, has also supported investors’ approach of “buying the dip” during market sell-offs in the hopes of making significant gains when the market rebounds.

Despite Mr. Trump’s statement that he would terminate trade discussions with Canada, the index reached a record on Friday. Despite the renewed trade tensions, the market’s earlier gains throughout the day were tempered, but not enough to prevent the S&P 500 from reaching a new record as it edged 0.5% higher.

The current recovery has been supported by strong economic statistics, which have not yet confirmed investors’ concerns that the new administration’s policies may result in an increase in layoffs or a sharp increase in inflation. The stock market surged even more recently as a result of the easing of hostilities between Iran and Israel, which resulted in lower oil prices.

Despite this, worries persist. Data due later in the year will, according to several economists and analysts, reveal indications of weakness more clearly.

New York Life Investments economist Lauren Goodwin predicted that in the upcoming months, the uncertainty surrounding U.S. policy will result in sticky prices, sluggish job creation, and decreasing business profits, but that the data won’t include a “bang” in the next month or two. The market’s cautious optimistic attitude may continue until then.

However, there are indications that the current rebound is not supported by broad investor optimism. The continued weakness of the U.S. dollar is a notable indicator that demand for American assets may be declining.

“It is incomprehensible that markets are so buoyant,” said Kristina Hooper, chief market strategist at Man Group, a global investment manager, citing tariff uncertainty and gradually deteriorating economic data. “Nonetheless, equities continue to rise,” she said. “It seems to be a recipe for disappointment.”

A few major tech firms that have a disproportionate influence on the index have contributed significantly to the rally. The more subdued rebound for the remainder of the market is obscured by the gains made by these firms, whose share values fell after tariffs were first announced.

According to statistics from Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, the S&P 500 would still be about 10% below its high point if it weren’t for the performance of only seven stocks, collectively known as the Magnificent 7: Microsoft, Apple Amazon Nvidia Meta Alphabet and Tesla.

Additionally, the average increase over that time is only slightly over 2%, according to Mr. Silverblatt, which is significantly lower than the more than 30% rise in the Magnificent 7 stocks, even though more than 8 out of 10 stocks in the index have increased over that time.

Although the rally does not appear to be coming to an end anytime soon, derivative market investors are prepared for a decline later in the year. At least in part, they probably represent stock investors seeking to shield their assets from a possible sell-off.

In a nutshell, many of the anxieties that investors and analysts had prior to the implementation of the tariffs persist. However, shares have rebounded to their previous level, suggesting that the tariff news’s initial shock has mostly subsided.

The market’s rebound has been largely driven by Mr. Trump’s choice to withdraw his planned tariffs. Every major increase since April 9—when the S&P 500 increased by 2% or more—has taken place on a day when a major announcement has been made regarding tariff regulation. The largest was on May 12, when China and the United States agreed to cease reciprocal tariffs that had exceeded 100 percent and had, in effect, constituted a trade embargo. The percentage was 3.3%.

The market is still being battered by tariffs. The Trump administration indicated on Friday that, rather than reinstalling tariffs in July, it was prepared to provide nations additional time to negotiate agreements. However, later in the day, Mr. Trump declared that he had broken off trade negotiations with Canada due to a new levy that the nation would be levying on digital services, which caused shares to decline somewhat.

Additionally, investors are increasingly optimistic that the Federal Reserve may reduce interest rates sooner than anticipated. Lower interest rates have a tendency to boost stock prices, lowering expenses for businesses and boosting consumer spending.

Even so, it probably won’t be enough to change analysts’ predictions of lower profits for businesses in the current quarter, and this might halt the stock market’s continuous rise.