Trump Tax Policy Checks Market Reality

Trump Legislators are in a bind as they press for substantial cuts that might significantly raise Treasury bond yields. The massive debt in the United States.

Calculating the costs of a megabill

American government bonds have investors on edge. Traders seemed concerned about a Republican budget plan that might bring the fiscal debt of the United States to a historic high, causing the yield on the 30-year Treasury bond to surpass 5% on Wednesday.

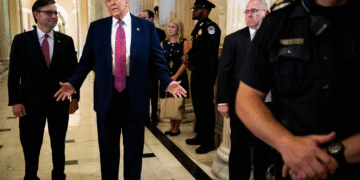

During his visit to Capitol Hill on Tuesday to garner support for the bill, President Trump said nothing about it.

A reminder of the stakes: The measure will determine fiscal policy for years and could be crucial to Trump’s domestic agenda.

Furthermore, it has caused international investors to question whether America is still a worthwhile investment. Currently, traders are betting on rising deficits, which would increase yields and, as a result, increase borrowing costs for families and businesses.

Is it possible that this would influence the vote? Given their little majority, House Republicans can only afford three defectors. According to Politico, there is a possible breakthrough in the contentious discussion over deductions for homeowners’ state and local taxes, but there are still significant disparities regarding reductions to Medicaid.

It also includes finance for Trump’s “Golden Dome” missile defense shield, which might cost up to $542 billion. (According to Reuters, SpaceX, Palantir, and Anduril are in line to receive contracts for this project.)

What’s next? Some examples include the following:

The current situation persists. The government has been spending more than it has been collecting for more than two decades. According to Moody’s, which lowered the United States’ debt rating on Friday, the federal debt will reach around 134% of GDP by 2034. Investors at that level are likely to demand a higher premium for American debt. This would result in greater returns, particularly for the 10-year Treasury notes that support mortgage rates and commercial lending.

Lawmakers alter their course. As business leaders have long advocated, they keep a tight check on expenditure. According to Trump’s former Treasury Secretary Steven Mnuchin, speaking at a meeting in Qatar on Wednesday, lowering the deficit should be a top priority. Republican Texas Representative Chip Roy, a strong fiscal conservative, concurs, calling for even greater budget reductions in the bill—and incurring Trump’s wrath.

The Fed intervenes. In previous crises, the central bank purchased government bonds in order to lower yields and draw in additional investors. Since 2022, however, it has taken the opposite strategy, reducing its balance sheet. The Fed chair, Jay Powell, has often been persuaded by Trump to cut interest rates. Quantitative easing, which Republicans have historically opposed, may now be demanded by the president from the Fed as well.

THE CURRENT SITUATION IS AS FOLLOWS:

“A lot less” money will be spent on elections, according to Elon Musk. Having given over $300 million to President Trump and other Republicans in the 2024 election cycle and this year in Wisconsin, the billionaire declared at a symposium on Tuesday, “I’ve had enough.” The billionaire left the possibility open to resuming big contributions in the future, even if his work in the Trump administration and donations are having a detrimental impact on his enterprises and are politically counterproductive.

Andrew Cuomo is being investigated by the Justice Department. According to The Times, federal prosecutors are investigating claims that the former New York governor misled Congress about the choices he made during the outbreak. The action occurs after the Justice Department, under Trump, withdrew corruption allegations against New York City Mayor Eric Adams, whom Cuomo is ahead of in the polls in his bid for the city’s top post.

Google is banking on a search engine makeover powered by artificial intelligence. The technological behemoth said on Tuesday that it would introduce an “A.I. mode” chatbot, which it expects would help it compete with the likes of OpenAI. However, since the chatbot mode does not display the typical list of blue links leading to other websites, publishers have been concerned that such a change would reduce traffic to their sites.

A Bloomberg terminal outage causes concern among traders. On Wednesday, users of the top financial information service, which costs $28,000 per terminal annually, voiced concerns about delays that impacted pricing events, such as a British government debt sale. Bloomberg’s help desk sent out a statement saying that the problem was being fixed.

Rippling asserts that the Deel battle is getting worse.

A rival company, Rippling, accused the start-up Deel of corporate espionage in March, in a charge that sounded like it came straight out of a thriller, disrupting the quiet field of human resources. Leading the list is Rippling’s charge that Deel had placed a spy in its organization.

Deel responded by filing a counter lawsuit. However, according to Michael de la Merced’s initial report, Rippling now claims that federal prosecutors are looking into the situation in a document that was sent to a few shareholders on Monday.

A summary: Rippling filed a lawsuit against Deel in March, alleging that its rival had recruited a mole in its Dublin office in order to steal its trade secrets. (According to Rippling, the scheme was discovered through a “honey pot” trap involving a Slack channel.) The accused spy, Keith O’Brien, later admitted to helping Deel and named Deel’s CEO, Alex Bouaziz, as one of his main contacts.

Rippling has been accused of its own improprieties by Deel, including stealing money from customers, while Deel has maintained that it has done nothing wrong.

According to Rippling, the American authorities are now participating. The firm informed a few shareholders, such as current and former workers as well as early investors, that it had reported Deel’s behavior to federal law enforcement and that it “understands an active criminal investigation into Deel’s conduct is ongoing.”

Rare earths are China’s trump card.

The Beijing-Washington detente is showing signs of breaking down. By targeting Huawei, the Trump administration was accused by China on Monday of endangering a tenuous week-old trade truce.

China has the financial means to be tough. Corporate America is paying attention to how its control over important supply chain resources, notably rare earths, allows it to cause harm.

President Trump’s advisors have been privately warned by American automakers that China’s threat to limit these vital minerals may have a negative impact on manufacturing and increase vehicle prices. According to Grady McGregor, they want trade negotiations to prioritize long-term supply access.

“It’s China’s trump card,” stated Gracelin Baskaran, the director of the Center for Strategic and International Studies’ Critical Minerals Security Program. “Rare earths are the single biggest bargaining leverage China has.”

Background: In retaliation for Trump’s tariffs, China restricted the sale of seven similar minerals in April. American automakers were concerned by the action because China has 90% of the world’s supply of rare earth elements, including dysprosium, which is used in magnets that propel electric vehicle motors.

These materials are also used in airbag sensors, power seats, traction control technology, and electric vehicles. Michael Dunne, the CEO of Dunne Insights and a former automotive manager in Asia, stated that “it may bring assembly plants in the West to a standstill.”

China’s government said last week that it would halt some export limitations. However, it continued to restrict international firms’ access to certain uncommon rare earth elements, such as dysprosium.

For a long time, American officials have seen China’s dominance over rare earths as unsustainable. These minerals are also essential to the military. In spite of Trump’s preoccupation with the matter, a solution has remained elusive.

The United States and other nations are increasing their efforts to mine rare earths. However, China has a significant advantage because of its leadership in the processing of minerals.

Trump made domestic mineral production a national security priority in March. Recent agreements between the United States and Saudi Arabia demonstrate attempts to diversify away from China through other partners. However, according to professionals, the United States will continue to depend on Beijing for at least a decade, if not a century.

What to look out for: According to Dunne, the United States may advocate for “uninterrupted supply access” in future trade negotiations. However, what would China want in exchange?

Retailers are choosy about what they say.

Major retailers are considering the difficult issue of whether and how to announce their intentions to raise prices in response to tariffs as they release results this week. Matters have been made more complicated by Trump’s retaliation against Walmart, in which he instructed the corporation to “EAT THE TARIFFS” in response to the news that it would be increasing some prices.

Home Depot took the opposite approach on Tuesday, informing analysts during its earnings conference call that it would not raise prices. According to a study by Allianz Research, the majority of U.S. businesses intend to increase prices. Therefore, communication will be the deciding factor.

What is the best course of action? According to retail analysts and pricing experts, the solution is most likely contingent upon the evolving tariff environment and businesses’ long-term strategy. The following are a few of the potential strategies.

Home Depot will “generally” maintain its pricing stable, according to management, as they play with semantics. However, David Silverman, a retail analyst at Fitch Ratings, pointed out that, despite the company’s efforts to highlight consistent pricing, management suggested that some rates may not always remain the same. He added that the firm may also increase rates in specific areas or at particular periods. (DealBook was unable to reach Home Depot for comment.)

In light of the politically charged nature of the word “tariff,” Denise Dahlhoff, the head of marketing and communications research at the Conference Board, stated that she was urging merchants to refrain from using it while discussing pricing policies.

“‘Tariff’ is provocative word than sourcing cost, input cost, or supply chain cost, which seems neutral terms to use,” she added.

Finding innovative strategies to reduce costs in order to avoid price increases: Analysts forecast a rise in private labels, sometimes known as store brands. With these items, merchants may have more control over aspects like the package size, which they can modify to lower some expenses. (Think: shrinkflation.)

However, according to Katherine Black, a partner at the consulting business Kearney who advises major retailers on pricing strategy, it is a medium to long-term plan.

Additional methods include larger firms attempting to persuade suppliers to shoulder some of the tariff burden. Home Depot stated on Tuesday that it was diversifying its supply chain in order to ensure that no single nation would account for more than 10% of its product sourcing within a year.

Additionally, the home improvement chain stated that it may alter its product mix to lessen price hikes. Mattel, the American toy manufacturer, announced this month that it, too, intends to cut manufacturing in China. Walmart stated last week that it may collaborate with its suppliers to gradually alter product quantities.

Is the purpose of tariffs to raise prices? There is some worry that businesses may be able to raise prices more than necessary since consumers are already preparing for inflation. It took place during the pandemic.